This article was originally published by Ohio Valley ReSource.

Curtis Cress sat in the gravel beside a railroad track in Harlan County, Kentucky. Tall and thin with a long, black beard, Cress is every bit a coal miner, or, he was until a month ago.

“It’s part of my heritage, you know? My dad and papaws had always done it,” he said. “And I’m proud of that heritage.”

Cress had been at these railroad tracks for days, with little sleep. Not far down the rails sat a row of hopper cars filled with coal from his former employer, Blackjewel Coal.

In the last month, Cress and his fellow miners have gone from moving coal out of the ground to stopping coal in its tracks. Blackjewel’s chaotic bankruptcy filing on July 1 left about a thousand miners like Cress with bounced checks and unpaid bills, and largely in the dark about their future.

Days turned into weeks, and miners had no way to know if they still had jobs, health insurance or access to their retirement savings.

On July 29, five miners saw an opportunity. A train full of coal was leaving a Harlan County loading facility. The five men clambered onto the railroad tracks to block the train. More than a week later, they hadn’t left.

“If they can move this train, they can give us our money!” miner Shane Smith said.

That rag-tag group quickly grew to a full-fledged protest camp, complete with solar showers, a chore list, and a rotating schedule of miners to hold the place down. Community members brought food. Politicians stopped by to make speeches. Kids played cornhole on the tracks.

“We’re suffering, our kids are suffering, water’s getting cut off,” Austin Watts said. “As long as I gotta stay here, I’ll stay.”

Arnold Shepherd, a miner from Leslie County, Kentucky, was among those who said the protest recalled an earlier period in Harlan County history.

“This thing here, it puts you in mind of ‘Bloody’ Harlan, back years ago,” Shepherd said.

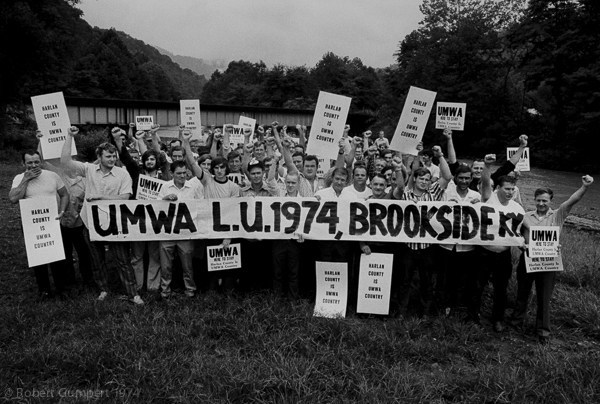

Bloody Harlan. The name comes from the nearly century-long and sometimes violent struggle between coal companies and workers seeking to unionize.

“Harlan is one of the locations used to undercut wage stability for the rest of the country,” Northern Illinois Univ. labor historian Rosemary Feurer said. Harlan miners started to organize in the 1920s, a struggle that culminated in a long and violent strike in 1931. Miners picketed again in the early 1970s, also sparking violence.

“What the miners were saying is, we can’t be basically just extraction engines and robots and tools left to die of black lung,” Feurer said.

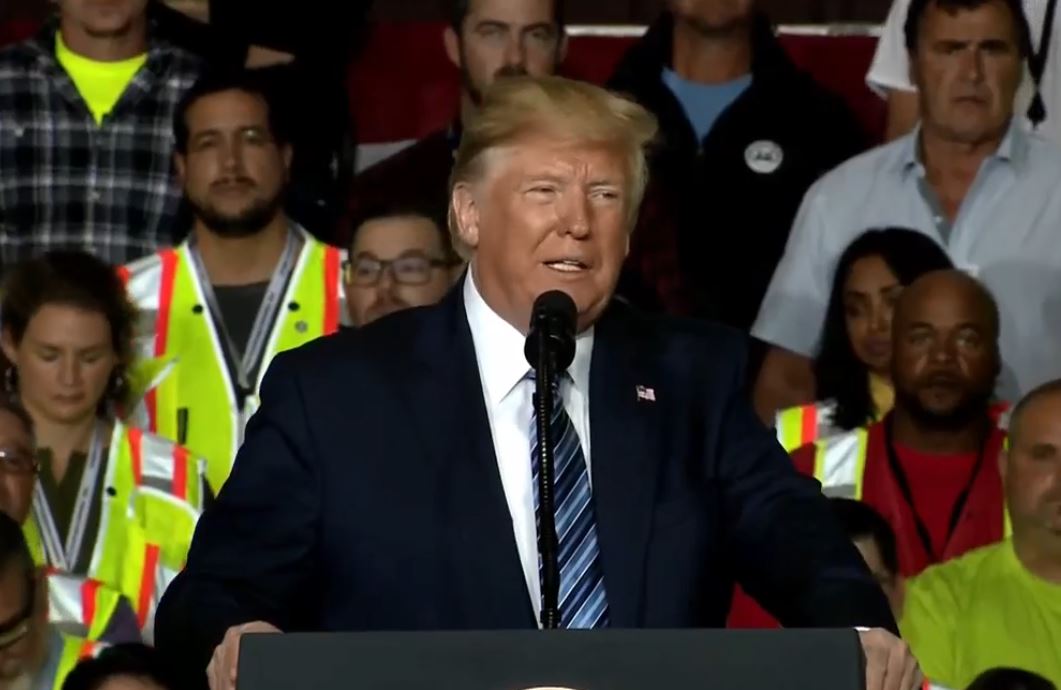

Today, the protest is peaceful. The union is largely gone from Kentucky mines. And the entire coal industry is a fraction of what it was decades ago. Blackjewel’s bankruptcy, though more chaotic than most, is just one of many recent shocks to a declining coal industry. Dozens of companies went under in the past decade, and despite a coal-friendly president rolling back regulations, more have followed. In 2019 alone, BlackHawk Group LLC, Cambrian Coal LLC and Cloud Peak Energy Inc. all went bankrupt.

With lower union representation and an expectation of more bankruptcies to come, miners’ advocates and industry watchers worry that coal miners and mining communities will suffer the brunt of the industry’s decline. The Blackjewel miners who took to the tracks are following in a long history of worker protest in Harlan County. They are also stepping into an uncertain future for themselves and their community.

Scene Of Labor Struggles

“You have to look at ‘Bloody Harlan’ in a long history of a bloody coal industry,” said labor historian Feurer, who has written about the region and legendary labor organizer Mother Jones.

Feurer said the coal industry pushes the full cost of coal onto workers’ health, workers’ wages and on the environment. The United Mine Workers of America, Feurer said, arose from workers’ demands for better treatment.

“It’s not only bloody for the labor violence, but for the death toll,” she said, from mining accidents and black lung disease. “It’s more than most wars.”

The UMWA negotiated its first successful wage increase in 1898 and went on to fight for eight-hour workdays and standard measurement for coal. The union helped miners weather the mining industry’s boom and bust cycles, and many of the union’s hard-won health and safety standards are still in place today.

Mine operators viciously opposed miners’ efforts to unionize, particularly in Harlan County. In the bloody 1930s coal wars, miners known to be union members were fired and evicted from company-owned homes. Soon enough, most miners had gone on strike out of solidarity.

Conflict broke out again in the 1970s in what was known as the Brookside strike. Two miners were shot, and one died in a strike that lasted over a year and resulted in a new contract.

Labor Losses

But union membership is in decline across the country, and the miners’ union has declined faster than most. Between 1997 and 2017, overall mine employment in the Ohio Valley dropped by 50 percent. Union participation has declined much faster. Between 1997 and 2017, Ohio Valley miner participation in unions has dropped by 76 percent.

“The reason that unions have really been imperiled in the southern parts of the country is because they’ve been told the only way the South can rise again is by being a non-union, anti-union reserve for companies that were moving from the unionized areas of the north,” Feurer said.

Feurer said that even though the Blackjewel miners are acting without a union, their protest follows the tradition of labor action in the area.

“Putting their bodies on the lines is what I see is historically connected,” she said. “People who risk themselves, that is what has resonance to a long body of history.”

The Blackjewel miners still feel a strong sense of solidarity with their fellow workers. “If you work in the coalfield, you spend more time underneath that mountain than you do with your own family,” said miner Shane Smith. “These men are like a brother to me.”

Some UMWA retirees and other union workers have joined the Blackjewel miners on the tracks in a show of solidarity.

UMWA spokesperson Phil Smith said he thinks Appalachian coal miners lost their sense for the power of unions in the coal slump in the 1970s. Mine employment was low for nearly a full generation of workers entering the labor force, Smith said, effectively breaking the chain of stories passed from father to son, stories of how unions improved working conditions and fought for better wages.

By 2017 there were no union miners left working in Harlan County, and only a handful in all of Kentucky.

Phil Smith worries that a weak union puts miners at risk of losing protections that previous generations of miners fought for.

“The minute that a government who is intent on doing away with many of these worker protections feels like they can without there being any political blowback from doing it, they’re going to do it,” he said.

Policies like so-called “Right to Work” laws, which have been passed in 28 states, including Kentucky and West Virginia, threaten the economic viability of unions. Still, Smith finds hope in teachers’ strikes around the country, and efforts to unionize other workplaces.

“I think we’re seeing a resurgence in people making sure they have a voice at work.”

Chris Lewis was one of the first five Blackjewel miners who blocked that train on July 29. The bankruptcy has been a struggle, he said, but he and his wife have it better than do workers with young children.

Lewis has complicated views on unions. “I was raised union, and I believe in the union. But I also believe in a man’s right to feed his family, you know what I’m saying?”

He resents miners who call strikebreakers “scabs.” Still, Lewis thinks he and his coworkers wouldn’t be in this predicament if they had been in a union.

After his experience with Blackjewel, Lewis isn’t ready to give up on the industry. But he is giving up on Kentucky. Lewis leaves Kentucky later this month for a job in a coal mine in Alabama. In that new job, he’ll be a part of a union.

“The End Game”

The uncertainty many Blackjewel miners feel about their future is true for the coal industry as a whole. Declining demand and competition from cheap natural gas from fracking has led to the closure of eight coal-fired power plants in the Ohio Valley since 2010, with more planned to shut down in the future.

“No matter what policies are developed and put forward in D.C.,” said the UMWA’s Phil Smith, “the fact of the matter is, coal-fired power plants are closing.”

Additionally, renewable energy makes up an increasing share of the nation’s energy portfolio. For the first time this year, renewable energy exceeded coal in percentage of energy generated in the United States.

In 1997, there were about 18,000 coal jobs in Kentucky. In 2017, there were about 6,200. According to the Appalachian Regional Commission, coal production has fallen most sharply in Central Appalachia compared to other coal-producing regions.

Kentucky Coal Association spokesperson Tyler White said his group is committed to fighting for the longevity of the industry.

“The coal industry is still struggling with a lot of over-burdensome regulations that were put in place under the previous administration,” he said. Most energy analysts contest that view and point instead to the market forces driving coal’s decline.

Similarly, the UMWA’s Smith said that he’s not ready to give up on coal. He fears significant regulation to prevent further climate change could put the coal industry out of business, and he views the union’s role as advocating for policies that would promote clean, safe coal mining and keep miners employed for generations.

Blackjewel’s bankruptcy has been messier than most. But Clark Williams-Derry, the director of energy finance for Sightline Institute, a research organization based in Seattle, says we should expect more chaotic bankruptcies like it.

“We’re sort of in the early stages of the end game, I would say, of the coal economy,” he said.

Williams-Derry worries that in the chaos of Blackjewel’s bankruptcy, some mine lands may end up without money to pay for reclamation, and he thinks future bankruptcies may have the same result as fewer companies want to take on risky mines. The costs of worker pensions, land reclamation and other debts may well be passed on to taxpayers, or left unpaid altogether.

“We’re in uncharted territory,” he said. “We don’t really know what happens when the industry is shrinking so rapidly that we see mines just simply abandoned.”

Down The Line

A marathon bankruptcy hearing in federal court brought mixed news for the Blackjewel miners. The auction of Blackjewel properties attracted enough buyers to generate money to go toward some of the wages owed, and lawyers representing the miners were able to win some concessions from other Blackjewel creditors.

Still, when attorney Ned Pillersdorf addressed the protesting miners on the tracks, he was clearly managing expectations.

“You know I’ve told you that bankruptcy is kind of like a funeral home,” he said. “Nobody leaves happy.”

Kopper Glo, a Knoxville, Tennessee-based mining company that purchased some of Blackjewel’s Kentucky properties, has committed to pay $450,000 to cover miners’ wages. That is expected to cover about 35 percent of the total amount owed to Blackjewel workers. Kopper Glo has also said it hopes to rehire many of Blackjewel’s workers, though it has made no legal commitment to do so. Blackjewel miners worry Kopper Glo will pay less than Blackjewel did.

“I was a roof bolter, I made $25 an hour,” said Shane Smith. “A belt man, they make $22. A different company comes in, what’s to say everybody won’t make $20?”

Kopper Glo said it could not answer specific questions, but said in a press release that the company “has a plan to re-start certain operations and is confident this plan will bring jobs back to many of the former Blackjewel employees. Kopper Glo is also committed to funding to the portion of the back wages due to the employees.”

In days spent occupying the train tracks, the Blackjewel miners have plenty of time to consider what their future holds. Do they return to work and hope their new employer doesn’t meet the same fate as the last? Do they try to retrain in a new industry? Or do they look for another job, knowing they may never make as much money as they did in the mines?

“This ain’t a game, we ain’t a bunch of kids,” said miner Caleb Blevins. “We’re grown men with families. Around here in the Appalachian mountains, this is all we got, the coal mines. We’re too far in to try to go to college for 12 years. Our kids need us now, not in 10 years.”

Miner Tim Madden also just wants to get back to business as usual. “I think if they’d roll up here and issue us all a check, I’d be out of here, end of story.”

But Curtis Cress said he’s done with the industry. “You never know from one day to the next if you’re going to have a job,” Cress said. “They’ll get you used to making a whole lot of money and then take it away.”

A father of four, Cress is at risk of losing his home. He says he feels hopeless about what comes next, both for him and for central Appalachia. He thinks his best bet is to find work in manufacturing. He hopes his kids leave the region when they’re old enough.

The miners occupying the Harlan County train tracks say they’ll stand down when they see Kopper Glo’s money in their bank accounts. With mining starting up again in some of Blackjewel’s former mines, some men will likely be headed back underground.

But for many miners, and for the coal industry as a whole, it’s hard to know what’s coming down the tracks.

Benny Becker, Brittany Patterson and Jeff Young contributed to this story.