Independent grocery stores, which tend to be more prevalent in rural areas, had a tougher time dealing with the Great Recession than chain grocery stores, suffered worse during the Great Recession than chain stores, are a bigger share of the market in rural areas, While the number of chain grocery stores continued to increase during the Great Recession, the number of independent stores — which are more likely to be found in rural areas — fell.

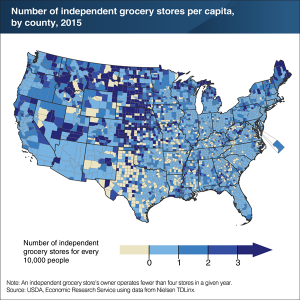

The growth of independent grocery stores, Rural counties are likely to have more independent grocery stores than their urban counterparts, though, as opposed to chains, though serve a larger percentage of rural communities than their urban counterparts, according to a new report by USDA’s Economic Research Service.

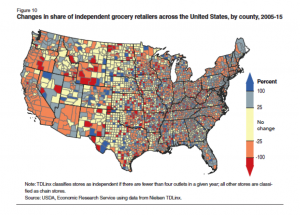

The study also shows that independent grocers in rural counties were harder hit by the Great Recession than such grocery stores in metropolitan counties.

Independent grocers, defined as those that own and operate four or fewer food retail establishments, are most prominent in rural communities in the Great Plains, the West and New England.

The report, “Independent Grocery Stores in the Changing Landscape of the U.S. Food Retail Industry,” studied the performance of independent grocers from 2005 through 2015. Independent grocery stores tend to be smaller in size and sales volume than corporate-owned or chain supermarkets. They accounted for 11 percent (or $70 billion) of total national sales in 2015.

In 2015, independents and their employees generated about $14 billion in state and local taxes and $13 billion in federal taxes. The stores collectively employ the equivalent of 330,000 full-time workers.

The study identified some differences in rural residents’ relationships with independent grocers, depending on the distance to the nearest urban area. On average, independent stores outnumbered chain stores in rural (defined as nonmetropolitan) counties that were not adjacent to a metropolitan county. However, sales from independents accounted for only 18 percent of all food retail sales in these counties. The shares of independent store sales were smaller in rural counties adjacent to metropolitan counties (16 percent) and in metropolitan counties (10 percent).

Demographically, the counties with the highest number of independent grocers per capita tend to have lower incomes and higher poverty rates. This explains why grocers with a higher share of total sales from USDA’s Supplemental Nutrition Assistance Program (SNAP) redemptions are more likely to be independently owned, particularly in rural areas.

Counties with higher per-capita numbers of independent grocers also were more likely to have higher proportions of African-American or Hispanic and Latino populations.

The Great Recession of 2007-2009 hit rural independents harder than metropolitan ones. Independent grocery stores’ market share fell nationally, but the decline was more prominent in rural counties, particularly the rural West. Rural areas in the Great Plains, which has the highest percentage of independent grocers, saw the fewest declines.

This study was conducted using Nielsen’s TDLinx data. The dataset provides a comprehensive list of food retailers, distinguishing between independent and chain stores, and estimates of annual sales for each store. The authors limited their analysis to the 3,108 counties in the 48 contiguous states in 2015 and the District of Columbia. Convenience stores and drug stores were excluded from the study.

This article was originally published in The Daily Yonder.