This article was originally published by the Ohio Valley ReSource.

West Virginia employees of coal operator Blackjewel LLC have received their final paychecks more than two months after the company declared bankruptcy on July 1.

In an agreement reached last week between the Department of Labor and the company, Blackjewel cut paper checks for all owed wages to a few dozen employees working at the company’s Pax Mine in Fayette County, West Virginia.

While good news for former West Virginia employees, about 1,000 miners in Kentucky and Virginia are still owed millions of dollars in back wages.

Christina Burgess’ husband, Greg, ran heavy equipment at the Pax Mine. The 20-year coal mining veteran had been laid off before, but the family had never before experienced the fallout from a paycheck bouncing, as Greg’s did in early July.

“It’s been unreal,” Christina Burgess said.

The Burgess family received Greg’s owed wages late last week, but is still waiting for the check to clear a bank hold.

Blackjewel’s bad check created a series of challenges. The first few unemployment checks the family received went straight to the bank to get the account out of the red. In total, Christina said Blackjewel’s bankruptcy has cost her family about $3,000 in penalties and fees.

Greg quickly found new work after the Pax Mine closed and the family had some money saved in preparation for a downturn in the local industry. Christina said she empathizes with younger miners who were hit hard by Blackjewel’s sudden bankruptcy.

As one of the administrators for the Blackjewel Employees Stand Together Facebook group, she has heard many stories of families unable to pay their bills as a result of not being paid by Blackjewel. She expects the fallout from Blackjewel’s bad checks to have long-term consequences as well.

“Everybody that’s involved in this right now their credit score has been damaged because of this,” Christina said. “And that’s hard to come back from when you when your credit starts going down.”

She said she reached out to more than three dozen West Virginia state senators and Attorney General Patrick Morrisey, but heard nothing back. She said she feels abandoned by West Virginia lawmakers who were slow to advocate on behalf of stiffed workers in the bankruptcy court and haven’t pushed utility companies or others to offer leniency to struggling Blackjewel families.

“They could have at least came in and said, you know, ‘don’t send turn off notices for the power bills, give them a little leeway,’” she said. “Nothing. We didn’t receive anything.”

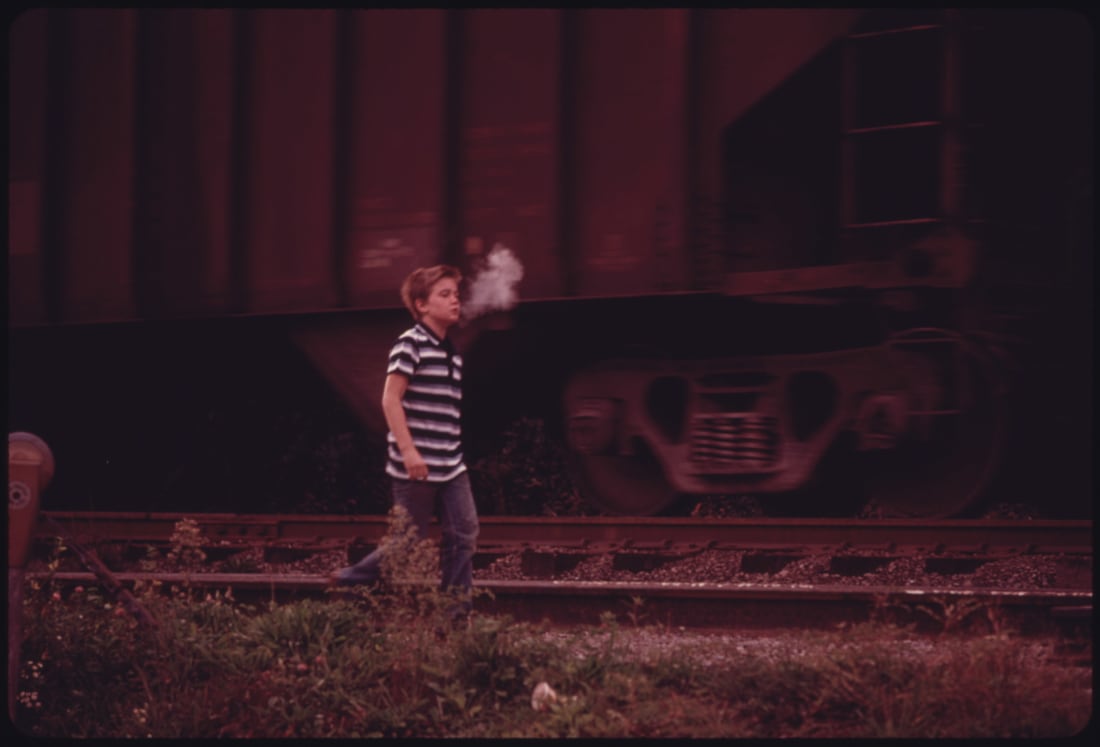

The Pax mine is now owned by Tennessee-based Contura Energy. About 1,000 Blackjewel employees in Virginia and Kentucky are still awaiting millions of dollars in owed wages. A protest on the railroad tracks in Harlan County is in its eighth week.

Millions of dollars worth of coal mined by former Blackjewel employees is sitting in railcars. The Department of Labor says the coal is “hot goods” and can’t be moved or sold until the workers who mined it are paid for their work.

Last week, the bankruptcy court in West Virginia overseeing the case gave the Labor Department, Blackjewel, and Blackjewel Marketing and Sales (BJMS) — buyer of the disputed coal — until Sept. 23 to submit a series of briefs to the court. A final set of briefs is due Oct. 1.

The judge said he expects to review the documents “swiftly” and rule soon after whether the coal should remain sitting until the Blackjewel workers who mined it are fully paid, or if it can be sold.

BJMS has proposed paying $1.4 million for the coal. The Labor Department says back wages owed to workers directly involved in producing the “hot goods” coal in Kentucky and Virginia totals more than $3 million.