This article was originally published by the Ohio Valley ReSource.

Brick buildings line the wide sidewalks of Main Street in downtown Coshocton, Ohio. On a recent spring day the dogwood trees are blooming. Bright red and white tulips dot the grassy public square, home to the local courthouse and a gazebo.

There are barber shops, an optometrist, a florist, a railroad-themed steakhouse is open for lunch. A trendy public art installment features a small roller coaster designed and built by the local high school and a marquee that blinks “be nice to others.”

But there are also vacant buildings.

Paula Wagner has lived in Coshocton for more than 40 years. She taught Spanish at a local high school for 35. Standing on Main Street, she says Coshocton has been a wonderful place to live, but it isn’t thriving like it once was.

“We still have some businesses, but I think every time one of these big businesses goes out, it takes so many people too,” she said. “They have to move to find jobs outside of town, or they’ll move their whole family.”

In recent years, thousands of jobs have been lost as major employers like General Electric, automotive mat maker Pretty Products, and a WestRock paper mill have closed their doors in the region.

Now, Coshocton is bracing for another blow. At the end of May, two of the three remaining units of American Electric Power’s Conesville Power Plant went dark. The last unit will shutter in May 2020, years earlier than expected. Coshocton is joining the growing list of Ohio Valley communities where coal plants are powering down.

“It’s an integral part of the community,” Denise Guthrie, owner of Mercantile on Main, said of the power plant, which has been operating here for over 60 years. Her shop has for 20 years sold vacuum cleaners and cotton quilting materials. Guthrie, a Coshocton native, greets everyone who comes through her doors like she knows them, largely because she does. Many of her customers, or their families, have worked at the power plant.

“We’re hurting,” she said. “You can physically see that there’s empty buildings, and that’s hard …I remember what it was, you know, but that was the past.”

Guthrie knows first-hand what that loss looks like. Her husband was laid off when the paper mill closed.

“It’s like, bam, bam, bam, you know, our community is hit, you see that,” she said.

Located in eastern Ohio, Coshocton has a mix of rural landscape and industrial labor common to much of Appalachia. It has rolling green hills and the occasional farm stand, but it’s also a place where people take pride in making things. And like so many communities in Appalachia, coal mined here, then later burned here to make electricity, shaped the fabric of this community, and helped give rise to its industrial roots.

In recent years, the community has tried to diversify.

“We have a lot to offer,” said Guthrie. Local wineries have banded together to create a wine trail, and a brewery has opened. Visitors can visit historic Roscoe Village, a restored 19th Century canal town, and hunting and fishing opportunities abound. Coshocton County is home to Kraft Heinz, the country’s largest bacon manufacturer, and American flag producer, Annin Flagmakers, as well as more than a dozen smaller manufacturers.

County and local officials haven’t been sitting idly by as Conesville’s retirement approaches. But as many communities in Appalachia have found, the loss of a coal-fired power plant is a major blow, even in places like Coshocton that are used to dealing with loss.

“I will say, we’re resilient, we’ll survive, we’ll find jobs, somehow we find jobs, we find new opportunities,” Guthrie said. “But it is a concern.”

Closing Conesville

The Conesville power plant began burning coal to create electricity in 1957. Over time, the plant grew to include six coal-fired boilers and could generate 1,590 megawatts of power.

The plant was a significant purchaser of Ohio coal, much of it mined by now-bankrupt Westmoreland Coal Company. At its peak, the plant employed 600 workers.

Plant Manager Ryan Forbes has worked at Conesville for 12 years. He will now oversee its closure.

“I’ve had four family members make lifelong careers here at Conesville, so it’s definitely close to me,” he said.

Shortly after he took the job, AEP announced it was moving up the timetable for the plant’s closure by two years.

Units 5 and 6 at the plant, which were originally scheduled to shut down in 2022, are closing now. Unit 4 is scheduled to close in May 2020. As of June 1, Forbes said, the plant will have 95 workers. They started the year with 160. About 25 employees have found other jobs elsewhere within the AEP system, and some are retiring.

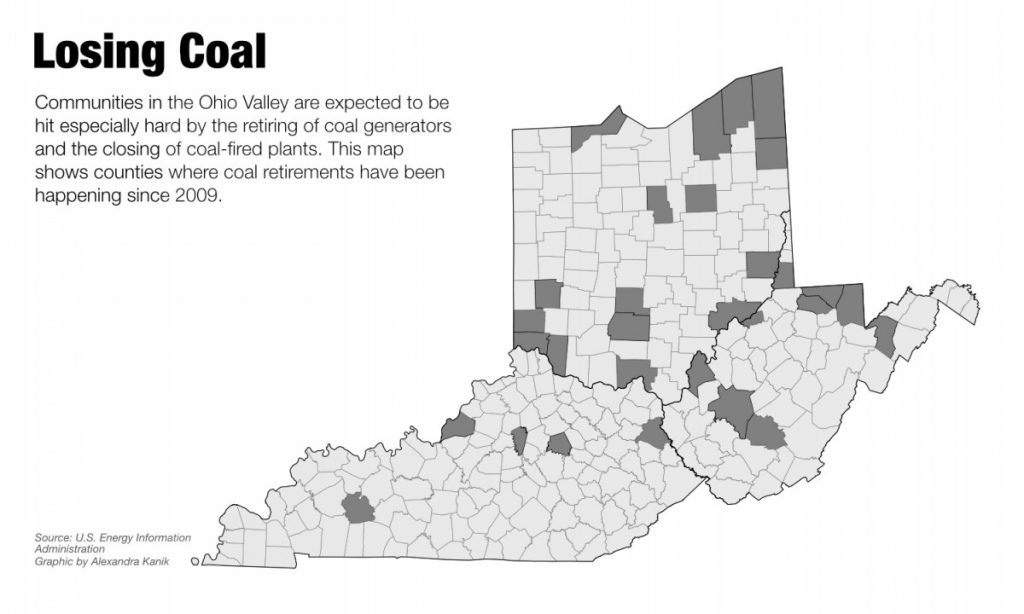

Coshocton is not alone in facing a future without a coal-fired power plant. According to the U.S. Energy Information Administration, from 2007 through 2018, more than 500 coal-fired generators, representing roughly 22 percent of all coal-generated electricity capacity, retired. In the Ohio Valley alone, 34 coal-burning facilities closed from 2009 to 2017.

Cost is the biggest force in the decline of coal, as renewable sources and gas-fired generation are proving cheaper and more flexible.

And there are more closures to come. Utilities have announced the retirement of at least 36.7 gigawatts of coal-fired capacity through 2024 — 117 units in total, according to a recent study by the Institute for Energy Economics and Financial Analysis. Increasingly, utilities are moving up retirement dates for their old coal burners.

Communities in the Ohio Valley are expected to be hit especially hard. In addition to the Conesville closure, utility FirstEnergy Solutions is shuttering three power plants over the next four years. The Bruce Mansfield power plant in Beaver County, Pennsylvania, W.H. Sammis power plant in Jefferson County, Ohio, and Pleasants Power Station in Pleasants County, West Virginia, are all set to close by 2022. The Tennessee Valley Authority voted in February to close the last of the coal-burning units at its Paradise power station in Kentucky, after switching to a new natural gas generator two years ago.

“These are huge economic drivers in the regions that they’re in,” said Gilbert Michaud, an assistant professor of practice at the George V. Voinovich School of Leadership and Public Affairs at Ohio University.

Since 2010, eight coal-fired power plants have closed in Ohio alone. Michaud has studied the associated impacts of these closures.

“They employ hundreds of workers, they have this rippling effect through the use of vendors and supply chain … where they are really driving activity and creating jobs and a lot of ancillary industries too,” he said. “A lot of these rural communities that don’t have very diverse economies, these are core industries and core facilities that are really driving economic development and jobs in these regions.”

Michaud and colleagues published a study in February that examined the impacts of the closure of two Dayton Power and Light coal-fired power plants last year in Adams County, Ohio. They found the county and local government and school districts were set to lose $8.5 million in tax revenues due to the closures, 370 direct jobs and another 761 associated jobs.

Michaud said displaced coal plant workers have limited local options to find new employment.

“We did find that there were emerging industry clusters in things like tourism and rural healthcare, but the problem here is that these folks would face like a wage challenge if they were to transition to new careers altogether,” he said. “And so a lot of these folks have been moving away, both throughout Ohio and out of state altogether, unfortunately.”

Cutting School

Conesville lies just a few miles outside Coshocton. The power plant’s three massive smokestacks have been a fixture of the small town’s landscape for decades, alongside a convenience store, post office, and a school, Conesville Elementary.

River View Local School District Superintendent Dalton Summers said having the power plant in the district was a huge advantage.

“When you have a power plant in your district it’s almost a separate tax source,” he said.

Until recently, Conesville was valued at $72.2 million, and it paid a significant amount of property tax and a state utility tax to the county and school district. Of River View’s $221 million annual budget, 10 percent comes from the power plant.

Because of that high level of local funding, Summers said River View has traditionally received less funding from the state. Still, the millions paid by the plant locally in taxes made that a worthwhile trade-off.

“River View was able to offer a lot of things that a lot of rural communities wouldn’t be able to offer,” he said, including eight advanced placement courses at the high school, three foreign languages, a swim team, and small class sizes.

The last time the district built a new school it didn’t have to ask local taxpayers to chip in. In fact, Summers said the district hasn’t asked for a new operating levy in more than 25 years.

In October 2017, the Ohio Department of Taxation devalued the plant from $72.2 million to $34.7 million, resulting in a $1 million revenue loss for the school district. When the plant is fully closed, the district is expected to lose $2.2 million.

“We tell people if you just take 10 percent out of your own income, you’re going to have to make adjustments to that,” he said. One adjustment: River View will close one of its four elementary schools next year. In order to avoid other cuts, Summers expects the district will need to ask for taxpayer support in the coming year.

Conesville’s closure is more than just a financial blow, he added. AEP has been a partner to the schools. If they needed something, they could call.

“It’s not going to just affect the school in the sense of money,” Summers said. “You know, we have a lot of employees, we have a we have a lot of kids’ parents that work for this plant, and this could cause relocation on their account.”

Summers said he thinks this closure, unlike some of the others the region has weathered, is different.

“Make no mistake it is a big impact. Any plant that closes in a small community is a big impact,” he said. “A plant like AEP, with the level of jobs that it did provide, the good livings people made that work there, the tax base to the schools — it’s really big.”

United Front

Local officials are not sitting idly as the plant closes down.

Inside a former hotel now converted to office space, Coshocton Chamber of Commerce Executive Director Amy Stockdale sits with Tiffany Swigert, executive director of the Coshocton Port Authority, and Sherri Gibson, with Ohio Means Jobs Coshocton County.

“This group of ladies sitting right here, we have a really strong united front locally as to how we’re going to help our community through any type of loss,” Swigert said.

Each of these women work with the local business community. They’ve also each been personally affected by a past business closure in the region.

“We have had moments of heartache and then picked ourselves back up and said, ‘okay, we can pull through this, we’re going to be able to do it,’” she said. “And we’ve done it quite well in the past.”

As AEP prepares to close its doors, they have devised a multi-pronged plan to help the community that borrows heavily from their experience dealing with past manufacturing losses.

It includes working to identify sites for new manufacturers and cleaning up existing brownfield sites to boost the tax base. Swigert admits the efforts, driven in part by grant funding, are in the early stages.

For workers facing unemployment, Ohio Means Jobs and Coshocton County Job and Family Services have stepped in to offer resume writing and interviewing classes at the Conesville plant.

“I think it’s really important to recognize that these employees, a lot of them graduated high school and went straight to AEP afterward,” Swigert said. “It’s not that they don’t necessarily know how to interview or create a good resume, but they never had to.”

The local branch of Central Ohio Technical College hosts job fairs. Gibson said interest in employing laid-off AEP workers is running high.

“Just the initial rumors of AEP closing, the surrounding counties lit up on my phone because they know that these workers are loyal, and that they’re faithful and that they are skilled,” she said.

Heidi Binko, executive director and co-founder of the Just Transition Fund, a nonprofit that works with coal communities undergoing transition, said as a growing number of communities find themselves facing coal plant or mine closures, it’s smart to throw everything they have at what comes next.

“There is no one silver bullet, right?” she said. “There is not one thing that is going to work.”

Ohio University Professor Michaud agrees and said in Ohio local economic development organizations and others are heavily involved in supporting workers affected by coal plant closures. But he said his research has shown limited participation by workers.

Michaud has examined transition efforts by communities across the country and the world, and said many try to leverage local assets, such as tourism or agriculture, with varying levels of success. A coal plant closure, he said, is a uniquely large economic loss that is hard to get past.

“A lot of these communities, we found haven’t really fully been able to bounce back to what they once were after a large coal plant closes,” he said.

He said rural communities with limited job options are wise to offer technical assistance, job training, and reemployment.

“Basically, give folks options so they aren’t forced to leave,” Michaud said. “I think that there’s a lot of people who really care about these issues, and that really love these rural Appalachian communities and counties, and that are trying to do things to help enhance the well being of the folks that live there and keep them in the region.”

Moving Forward

Joe Eggleston has worked at the Conesville plant for six years and he hopes to stay in Coshocton. He attended both a resume and interviewing class hosted at the plant by Ohio Means Jobs. During a mock interview, Eggleston used his quiet confidence to win over Gibson, even when she threw him a curveball question: “If you were a tree, what type would you be?”

Without missing a beat, Eggleston answered. “An oak,” he said, “very strong, very sturdy.”

“I like that,” Gibson grinned. When Eggleston mentioned he’d only missed two days of work in the last six years, she exclaimed, “You’re hired.”

Working at Conesville was a lifelong dream for Eggleston. His father worked there for 25 years before him, and he’s enjoyed his time at the plant.

“It is sad, you know, there’s been a lot of generations that went through here,” he said.

But he also isn’t worried about his last day; he’s confident he will find a job.

“I hoped it would last longer,” he said. “It is what it is, and I’m just going to move forward.”