The nation is not keeping pace with repairing and replacing more than 400,000 affordable rental units that serve low-income rural residents. Without action, a cascade of rentals will age out of the program, creating a housing gap that could contribute to rural population loss, according to the Housing Assistance Council.

Rural America faces an affordable-housing crisis that, if left unchecked, could raise rents for low-income residents and contribute to rural population loss in coming years, a national nonprofit organization says.

The Housing Assistance Council (HAC) sounded the alarm during its recent biannual conference.

The question is not “if,” but “when” the crisis will occur, according to HAC.

Hundreds of thousands of rental units could age out of a USDA affordable housing program in the next 25 years. The result is likely to be steep rent increases for rural residents who can least afford it.

“There are about 415,000 units still in existence in this program,” HAC’s CEO, David Lipsetz told the Daily Yonder at the conference in Washington, D.C. “Every single one of those units is on a time clock. Every single one of those units without some action to recapitalize the property is going to deteriorate.” Without reinvestment, the properties will have to leave the affordable rental program.

“We have these units, we have this stock,” Lipsetz said. “If we don’t fund it well enough to even keep what we have, we’re going to continue to depopulate rural places.” He said failing to allocate enough funding for upkeep and rehabilitation will mean that rural communities will lose an important asset.

Though the rural cost of living is lower than it is in major metropolitan areas, adequate housing is still a big problem in smaller communities, said Stephen Sugg, HAC’s government relations manager.

“We’re learning that in rural housing, there is a crisis and people think that it’s different than urban America,” he said. “It looks different, but very high percentages of rural renters are paying over half their income in rent.” Losing affordable rental units that were constructed through the USDA 515 program will make that problem worse, Sugg said.

USDA’s Section 515 Rural Rental Housing is among the few rental housing programs specifically for rural communities, according to the HAC report. The program started in 1963 and has financed more than 533,000 apartment units in nearly 28,000 different developments.

The program supports mortgages for the builders of rental housing for very-low-, low-, and moderate-income families, elderly persons, and persons with disabilities.

Those groups face the gravest danger. Once the properties that hold their units exit the program after being paid off by the owner, the individuals might find themselves unable to participate in the unsubsidized rental market.

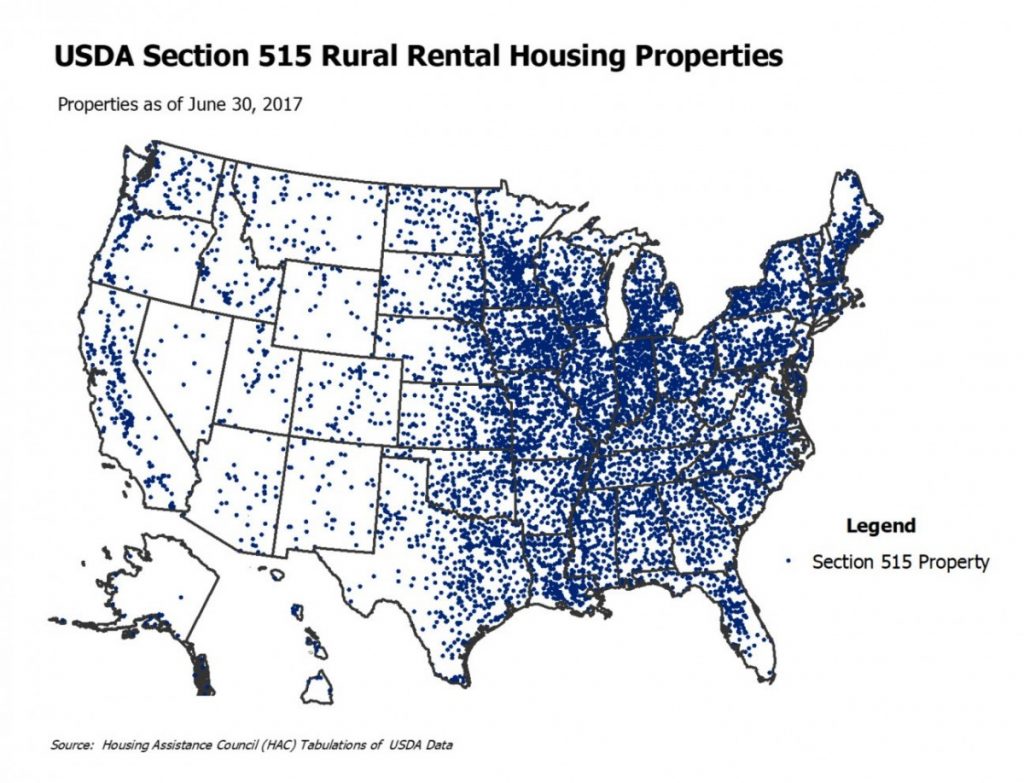

Just how big of an issue for rural America is the housing provided through the Section 515? According to HAC’s data, 87 percent of all counties in the United States have at least one USDA multifamily property.

“The leading edge social science research now tells us that housing is one of the most powerful predictors of your wealth, of your economic mobility, your educational outcomes and very importantly your health outcomes,” Lipsetz told the Daily Yonder.

What worries analysts and researchers at HAC is the number of maturing mortgages on the Section 515 properties that will exit the market. According to the report, nearly 90 percent of USDA’s portfolio is over 20 years old, while over half of those properties are over 30 years old.

“When a USDA Section 515 loan ends for any reason, the property also loses its Section 521 Rental Assistance. Some properties are restricted to low-income use for a period of time after they leave the program. In instances where there is no restrictive use provision, owners may increase rents to levels their low-income tenants may not be able to afford,” states the HAC report.

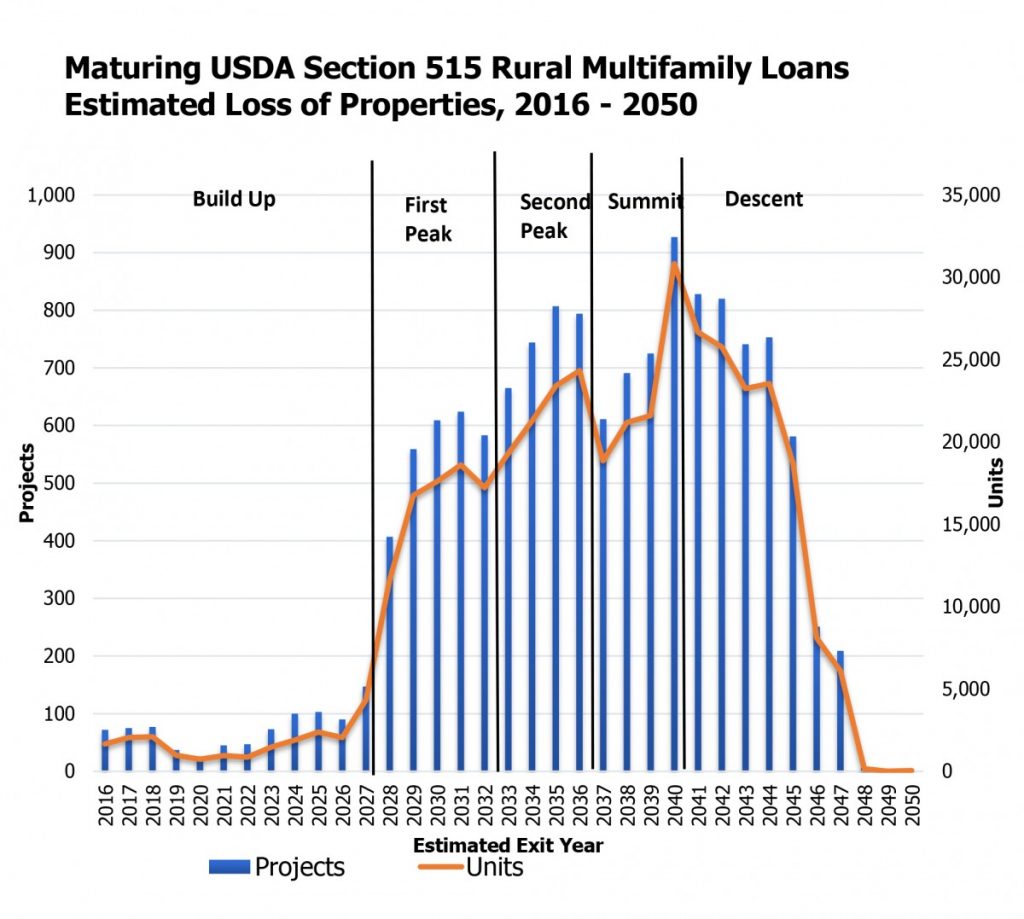

The numbers of units that will no longer be available in the coming decades to some of the poorest residents in rural America are staggering. We are currently in what HAC describes as the build up phase, meaning that the loss of projects and individual units in the coming several years will remain roughly under 5000 units per year.

But it is after that build up phase, while the affordable housing market enters the first peak phase, when the situation is projected to deteriorate rapidly.

Furthermore, over 48,000 units are located in what is characterized as high risk counties, meaning that the markets are either declining or rapidly expanding.

The consequences of mortgages maturing on the USDA properties will be compounded by other factors as well. Ninety percent of counties with Section 515 properties are counties persistent poverty. HAC estimated that in 77 of those counties Section 515 units constitutes more than 10 percent of the total rental stock.

“Over 5,400 Section 515 properties are in counties where more than half of all rental households are cost-burdened. The majority of these are located in the Southeast and Far West, with a relatively high percentage of African-American and Hispanic tenants,” concluded the report.

This story was originally published by the Daily Yonder.